What Will Be the Latest FinTech App Development Trends In 2023?

Businesses from different industries have shown a big inclination towards FinTech applications. In fact, it is astonishing to learn that the FinTech industry is expected to reach a massive $324 billion by 2024 (Market Data Forecast).

Thus, we get a clear idea about businesses being interested in FinTech app development to create highly secure and reliable Finance applications. This helps them to improve their existing services and banking infrastructure. Building a mobile is more beneficial for FinTech app companies as it allows them to capitalize on a much larger market. In this blog, we are going to talk about the latest FinTech app development trends in 2023.

Before we understand the trends, it’s important to learn about FinTech apps:

What is a FinTech App Development?

A FinTech application is basically a mobile app that enables mobile users to access financial services from the convenience of their mobile devices. Moreover, these applications provide more streamlined operations as compared with traditional digital finance solutions.

Finance companies often look for a top FinTech app development company to digitally transform their operations. For this reason, they are able to improve their operations, services, and reputation in the market.

FinTech technology has been there since the early days of ATM technology and online banking. However, it saw a massive transformation with the smartphone revolution. Instead of traditional financial institutions, new FinTech companies emerged by taking full advantage of FinTech app development services.

Latest FinTech App Development Trends In 2023

The FinTech industry has been growing rapidly with noteworthy innovations and drastic digital transformation. 2023 will be a year of change and drastic innovation. New tools and technologies might change the face of the FinTech industry with more openness, transparency, and security. The following could be the best and most noteworthy trends for the FinTech industry in 2023:

1. Chatbots for customer support

We are often tired of being stuck in a long and complex customer support process. Moreover, hotlines might have become a thing of the past. People nowadays want instant solutions to their problems without putting much effort on their side.

Therefore, implementing smart chats will be very helpful in enhancing customer support in financial institutions. This solution can also simulate human-like interactions through text, voice, or video. In fact, many other industries are also using these smart chatbots to improve the customer experience of their services. You can also implement an innovative chatbot by using trustworthy FinTech app development services.

FinTech companies can program these chatbots to build trust and provide a better customer experience to the end-users. Instead of manually reaching a hotline number, almost everything can be resolved through these chatbots.

2. Blockchain will ensure better security and transparency

Blockchain technology has made the largest impact on the FinTech industry with decentralization and distributed ledger. For this reason, many financial institutions are already trying to take the best advantage of this technology by hiring the best FinTech app development company.

Blockchain could be very helpful for finance businesses to reduce risks, ensure security, and provide better transparency to the stakeholders. Moreover, it is also a great step toward the efficiency and cost-effectiveness of financial processes.

Businesses like insurance companies can heavily benefit from Smart Contracts to enforce their policies without any hassle. Moreover, a lot of extra investments can be cut down by removing the intermediaries in providing financial services. Above all, the peer-to-peer concept of Blockchain technology is more cost-effective and efficient than any other technology.

3. Artificial intelligence (AI) for automation and innovation

Artificial Intelligence technology has been very useful in providing accurate predictive analysis with the help of historical data. Moreover, this technology has been implemented in various industries, such as healthcare, entertainment, sports, and manufacturing.

The Finance industry is also a big implementor of Artificial Intelligence technology. As a result, the industry is able to derive some of the most useful analytical insights from big data. Moreover, AI is known for enabling automation in the finance industry.

It can provide effective predictive analysis to minimize risks and maximize profits. Chatbots with natural Langauge Processes and face recognition systems can also be used to improve the customer experience and security of finance platforms.

4. Robotic process automation (RPA)

As the name suggests, this technology is getting implemented in various industries across the world. Thus, it can create the best positive trajectory for the FinTech industry in the coming years.

Banks & financial institutions often have huge pressure to continue their daily operations. Thus, introducing RPA would certainly make the processes more flexible and personalized for the end-users. Moreover, taking the help of the best FinTech app development company is highly advisable to ensure the right implementation of this technology. It would contribute to the simplification of the user flows in financial institutions.

5. Microservices will ensure better security

Security has been a major concern in the FinTech industry. Moreover, the growing cybersecurity threats from cybercriminals and fraudulent activities have created the demand for improved security measures.

Microservices would be very useful as server architecture to improve efficiency in dese and powerful banking environments. For this reason, many financial institutions are already using these services to reduce power usage, size, and capital expenses. Moreover, these services can be very helpful in hosting small-scale apps without the need for large enterprise-grade hardware.

6. Voice commands

Thanks to the massive innovations in virtual assistant apps such as Alexa, Siri, and Google Now, the demand for voice commands has been increasing every year. Accordingly, the FinTech industry can also implement this feature into their digital solution for extra convenience.

However, this technology is massively dependent on the security standard of the FinTech platform. It would be advisable to take quality FinTech app development services if you want the proper implementation of this technology.

7. Biometric for smoother authentication

Top finance businesses now consider biometric authentication to be a very important part of the FinTech app development process. It makes the authentication process smoother and more secure.

FinTech businesses will continue to give this a priority to identify the right user and avoid identity theft as well. Reducing friction is also an essential benefit of Biometric identification. Above all, the users don’t need to manually enter a password to access the features. They can simply use their finger impressions or face to login into the app.

We can also use biometric authentication as a form of two-factor authentication while verifying a transaction. It effectively saves the user from mistakes, fraud, or inconvenience. Thus, if you are also building a FinTech app, don’t forget to ask your FinTech app development company to implement this innovative feature.

8. Gamification for concept simplication and engagement

Not everyone is finally literate enough to understand all your financial services. Therefore, it becomes important to introduce an interactive solution to educate the users and also engage them for a longer period of time.

Many industries are also using their own attempt at gamification to include gaming activities in their offerings and experience. Accordingly, the FinTech industry can also educate its users, improve customer experience, and increase customer engagement levels. In 2023, there will be more finance companies trying to implement their own personalized programs, cashback rewards, educational videos, etc.

9. Emphasis on big data

The Finance industry has to manage gargantuan amounts of data every day to sustain various operations. Moreover, data management isn’t just limited to pen and paper or simple excel sheets. Today’s finance data is both structured and unstructured, making it incredibly hard to process and derive useful insights.

Big Data has been in trend for a couple of years now in the Fintech industry. It is a very useful technology to process tons of data and provide meaningful insights to finance businesses.

Accordingly, these insights are very helpful in making important business decisions. Thus, it becomes incredibly easier to comprehend a large amount of data from multiple sources with Big Data.

10. More Innovations In Payment Methods

The inception of payment service providers like PayPal, Alipay, Venmo, and Google Play have revolutionized payment solutions and customer experience. Moreover, ease of payment plays a very important role in determining the purchase decision of a consumer.

QR codes, NFC payments, mobile wallets, IoT, biometrics, and other technologies will continue to make the payment process much easier. By having more convenient payment solutions, businesses can ensure a better flow of funds through their financial system.

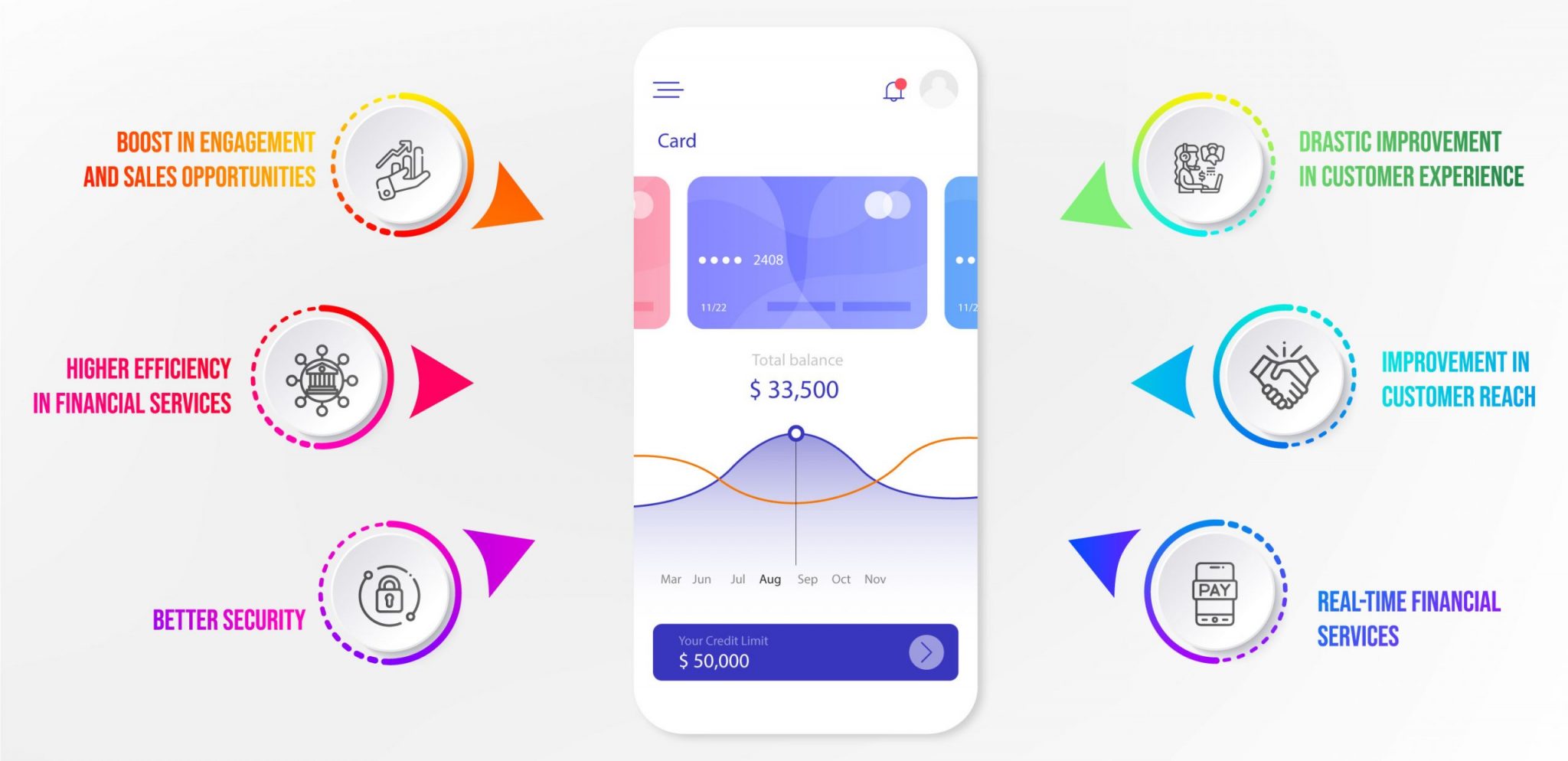

Benefits Of FinTech Apps

Developing your FinTech app can provide you with the following benefits:

1. Boost in engagement and sales opportunities

Developing mobile apps has become very important to keep engaging the customers with your business. Thus, your FinTech app can become an effective marketing and communication channel to reach your customers directly. The best FinTech app development company will help you to integrate the best gamification features, loyalty programs, attractive offers, and more.

Ultimately, these factors are crucial in driving sales for your business. Instead of promoting just your traditional services, you are able to create more revenue opportunities from innovative services.

2. Higher efficiency in financial services

Banks and other financial institutions can streamline their operations with the help of FinTech apps. Above all, the efficiency can be drastically improved by providing their services on proper mobile apps instead of age-old complex websites.

Moreover, this could also remove the need for paperwork and manual operations, which took a lot of time in traditional banking services. FinTech app development companies constantly put their best effort into using cutting-edge tools and technologies to improve the efficiency of financial services.

3. Better security

When you build your mobile app with the help of a top FinTech app development company, you are able to ensure better security with a modern tech stack and robust security features. Moreover, the underlying infrastructure of the FinTech app is far more secure than traditional FinTech websites. If you supplement your FinTech app with Blockchain technology, then you are able to ensure even better security standards.

4. Drastic improvement in customer experience

Customers these days often expect a fulfilling mobile solution to access financial services. Therefore, by building a proper FinTech app with the help of the best FinTech app development company, you to provide a better customer experience.

FinTech also lets finance businesses develop new innovative finance products & services for the unique demands of customers. Ultimately, providing your financial services at the comfort of users’ smartphone help you improve your customer experience.

5. Improvement in customer reach

Traditional banking often restricted its operations to specific geographical locations or platforms. Whereas, FinTech apps are playing a major role in ensuring better financial inclusion.

Plus, customers prefer using these FinTech apps to make online purchases or transfer funds instantly. When you take the best FinTech app development services, you are able to cover a larger demographic and attract new potential customers. Thus, you have better coverage when you invest in developing a FinTech application.

6. Real-Time financial services

Traditional financial services are time-consuming and complex. In the age of instant connectivity and convenience, people want real-time financial services. Therefore, innovative FinTech apps are able to provide real-time streamlined financial services to customers. Above all, people can expect a better user experience and transparency in these services.

Real-time transactions and financial information has become very important in making critical financial decisions.

The Impact Of COVID-19 On The FinTech Industry

The Covid-19 global pandemic brought a significant impact on various industries. Thus, the FinTech industry also saw massive implications of the pandemic and lockdown norms around the world. People started to pay more interest in digital financial services as a replacement for traditional banking.

Financial businesses were also forced to adapt technological solutions with the help of the best FinTech app development services. For this reason, COVID-19 was both a big challenge and an opportunity to innovate. The adoption rate of high-technology banking solutions also increased during this era.

These innovations and situations made banking more accessible and convenient for users. Moreover, security and efficiency are also getting very important with the rise of FinTech applications.

The Need For Open Banking

Traditional banks and financial institutions aren’t just limited to a few financial services anymore. They are getting connected with various organizations and industries for innovative services and operations.

Therefore, Open Banking has become a significant challenge for FinTech companies. However, innovative finance companies have been quick enough to implement and release their APIs to external organizations with full security and efficiency. If you want to enjoy the wonders of Open Banking, then it would be highly advisable to hire a top FinTech app development company.

Adhering To The Regulations

The finance industry has some of the strictest regulations in the world. Thus, every financial institution is expected to follow these regulations in order to participate in an economy. Finance businesses thinking about taking FinTech app development services must be willing to follow these strict regulations. Therefore, your development team should have adequate proficiency in adhering to international and national financial regulations while developing a product.

Building A World-Class FinTech App With MobileCoderz

If your finance business requires digital transformation, then building a FinTech app could be the best idea. As a result, it would help you to capture more customers and provide them with a better value and experience. However, building such a complex app on your own could be a very challenging and time-consuming process. Thus, you should hire the top FinTech app development company, MobileCoderz, to make the development process a breeze.

We have an extensive team of FinTech experts and a diverse portfolio of FinTech clients. Thus, together we give the assurance of quality development with cutting-edge technologies.

-

How Much Does It Cost to Build Fintech App In 2023?

How Much Does It Cost to Build Fintech App In 2023? -

Complete Guide To Fintech Mobile App Development

Complete Guide To Fintech Mobile App Development -

Top 8 Innovative FinTech App Ideas for Startups in 2023

Top 8 Innovative FinTech App Ideas for Startups in 2023